The Ministry of Corporate Affairs (MCA) has brought revolutionary change to Indian corporate compliance amendments under the Companies Act, 2013, from July month 2025. Secondly, these amendments are the biggest shake-up in corporate governance and digital compliance frameworks since the Act came into being, bringing in greater disclosure mandates, simplified compliance process, end-to-end digitization process through the MCA V3 portal, and robust workplace compliance regulations. The amendments impact more than 15 lakh operational companies in India and it has significant impact on businesses statutory compliance, requiring digital-first filing and increasing transparency obligations related to reporting of sexual harassment and compliances of maternity benefits.

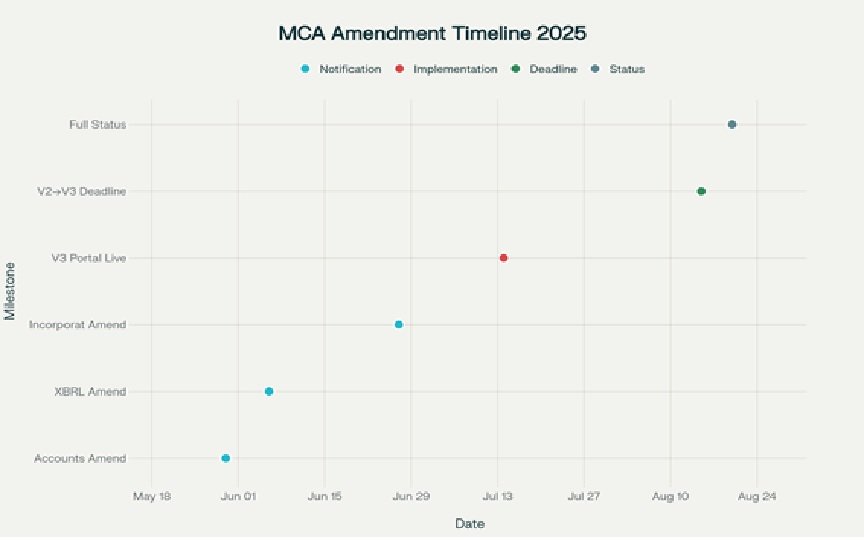

MCA Amendment Timeline 2025: Important Milestones and Implementation Dates:

Important MCA Amendments

Companies (Accounts) Second Amendment Rules, 2025

The Companies (Accounts) Second Amendment Rules, 2025, notified on 30th May, 2025 and comes into forced on dated 14th July 2025, reshape the companies report to stakeholders. These amended rules require companies to furnished detailed statement on workplace safety and gender-responsive governance in their Board’s Reports.

Sexual Harassment Reporting Obligations:

Companies are now required to make disclosures of certain information about complaints received under the Sexual Harassment of Women at Workplace (Prevention, Prohibition and Redressal) Act, 2013. The number of complaints received in the year, complaints disposed of during the year, and cases pending for over ninety days. Earlier, firms merely had to verify the composition of Internal Committees under POSH but are now required to furnish detailed statistical information that will be audited on a regular basis.

Maternity Benefit Act Compliance:

A fresh mandatory disclosure is to be made by companies in the form of a declaration stating compliance with Maternity Benefit Act provisions, 1961. This results that the government’s efforts ensure that workplace rights of women employees’ are not only adopted but conveyed properly and clearly.

Digitalization of Financial Statement Filings:

The amendment brings in web-based e-Forms AOC-4, AOC-4 CFS, and AOC-4 XBRL earlier PDF-based filing system. Companies filing AOC-4 XBRL are now required to attach mandatory PDF copies of audited financial statements duly digitally signed. The new system combines several forms as linked filings under the MCA V3 portal, viz., Extract of Board Report, Extract of Auditor’s Report, AOC-1, AOC-2, and CSR-2.

MCA V3 Portal Revolution

MCA Portal Evolution:

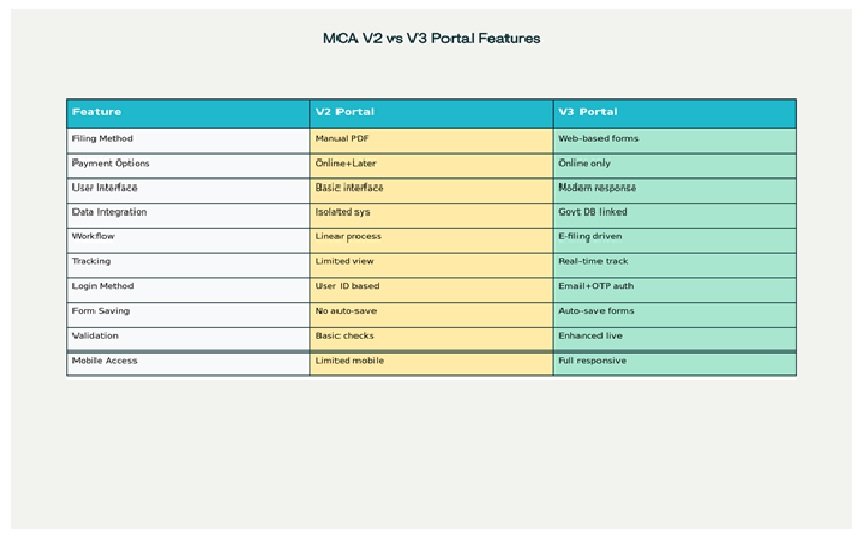

Major Feature Comparison between V2 and V3 Systems

The MCA V3 portal is a revolution towards smart compliance management system from manual-based process. It was launched along with the last batch of 38 e-forms on July 14, 2025, and it does away with the legacy PDF-based filing approach to adopt dynamic, web-based forms with auto-population and real-time validation features.

Improved User Experience Features:

The V3 portal provide various functions under “My Application- Dashboard”, it is customized dashboard that shows all forms submitted along with status—whether awaiting DSC upload, processing, or marked for resubmission etc. This mark significant from the V2 portal’s minimal “My Workspace” that essentially presented just notices and circulars.

Sophisticated Security Architecture:

Login is now streamline through email ID-based with OTP validation in lieu of login with user ID system. Basically, This platform follows bank-level security mechanisms with upgraded data encryption and end-to-end audit trails on every activity of the user.

Intelligent Form Management:

The system enables with some feature of auto-save of partially filled forms, pre-filled information on the basis of associated records of company earlier filed with authority, also has offline utility features for annual filings. In short pre-filled Excel templates can be downloaded by users, filled data offline, and uploaded directly to web-based forms.

Companies (Audit and Auditors) Amendment Rules, 2025

These 2025 amendments, effective from 14th July, 2025, comprehensively overhaul auditor reporting and communication practices. Rule 13(2) now requires electronic filing of reports using e-form Form ADT-4, rather than older process with postal and email-based filing systems. The amendment replaces all current ADT forms (ADT-1 through ADT-4) digitalized along with better versions.

Form ADT-1 now more transparent than earlier. It has distinct fields for audit partner information, to enhance audit assignment transparency. Form ADT-4 becomes the single repository for all communications by auditors with the Central Government in order to ensure standardized and traceable regulatory communications.

Other Important Amendments

Companies (Incorporation) Amendment Rules, 2025:

Notifies the new Form INC-22A for ACTIVE (Active Company Tagging Identities and Verification) to make the process of verification of companies more streamlined. This form is integrated with the strengthened validation features of the MCA V3 portal.

Companies (Cost Records and Audit) Amendment Rules, 2025:

Under new Amendment, Forms CRA-2 and CRA-4 for appointment of cost auditors and filing of cost audit reports respectively has been amended. Also, these amendments synchronize cost audit reporting with the new digitalization filing.

Companies (Management and Administration) Amendment Rules, 2025:

Brings through full-fledged revisions in MGT-7, MGT-7A, and MGT-15 forms with more disclosure needs such as gender-wise classifications of shareholders, obligatory photographs of registered offices, and shareholding information of FIIs. If you have any doubt regarding this, then you can send your doubts on company suggestion and our team of experts will guide you