Ind AS 103 scope:

Ind AS 103 applies to a transaction or other event that meets the definition of a business combination.

Scoped Out:

- Joint ventures.

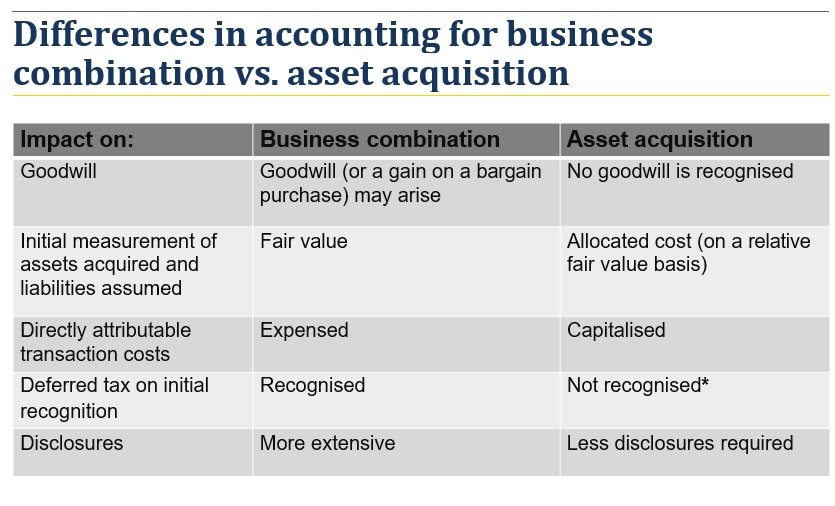

- Asset acquisition ( if not constitute a business)

- Combination of entities or businesses under common control (Dealt with in Appendix C of IndAS 103).

First of all we have to know the definition of Business Combination for the applicability of IND AS 103 on transaction.

Identifying a business combination:

Definition of Business:

Business consists of followings:

BUT only inputs and processes are mandatorily required:

- Inputs (e.g. employees, non current assets)

- Processes (e.g. Strategic/operation management )

Outputs are not mandatorily required for a set of activities and assets to qualify as a business. Development stage activities without outputs may still be businesses.

Note: Goodwill Presumption is that if goodwill exists, the acquisition is a business. BUT a business need not necessarily have goodwill.

Meaning of “Capable of”:

- If a market participant is capable of utilising the acquired set of activities and assets to produce outputs by integrating the acquired set with its own inputs and processes, the acquired set might constitute a business.

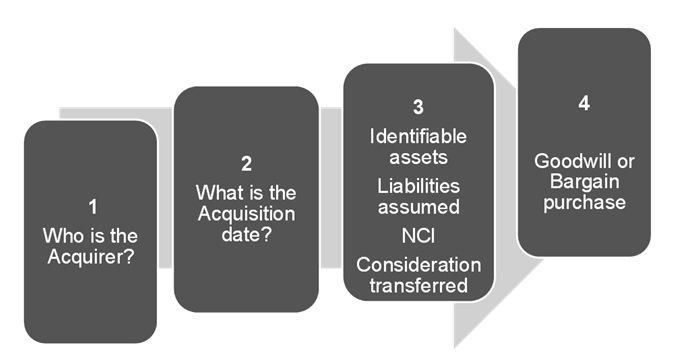

Application of the acquisition method:

– a 4 step process:

1. Who is the Acquirer?

For each business combination, one of the combining entities shall be identified as the acquirer.

- The entity that obtains control of the acquiree is identified as acquirer in all business

- The following factors are considered in making that determination :

- Acquirer is usually the entity that transfers the cash or other assets or incurs the liabilities.

- Acquirer is usually the entity that issues its equity interests.

- Acquirer normally has the largest portion of the voting rights in the combined entity

- Acquirer will have ability to elect or appoint or to remove a majority of the members of the governing body of the combined entity.

Specific case of formation of new entity :

Where a new entity (New Co) is formed to effect business combination between two or more entities, say B and C, IndAS 103 identifies two distinct scenarios :

1. New Co issues its equity instruments in exchange for equity instruments in B and C. Either B or C should be identified as the acquirer.

2. New Co transfers cash (or other assets) in exchange for equity instruments in B and C (e.g. from the proceeds of a debt/ equity issue to new investors) New Co may be identified as the acquirer.

Example:

X and Y are two existing entities carrying on business independently.

- The two entities decide to combine their businesses through a new entity Z.

- New entity Z issues equity shares in itself in the proportion two third to the equity shareholders of X and one third to the equity shareholders of Y.

Should Z be regarded as an acquirer?

Response:

- Z cannot be identified as acquirer; rather, either of the combining parties should be identified as an acquirer.

- In the existing case, based on the relative voting rights in new entity Z, entity X should be identified as the acquirer.

- Accounting for the BC is based on the principle that Z is a parent legal entity and X acquires Y.

2. Date of acquisition:

Generally the date on which the acquirer: legally transfers the consideration, acquires the assets; and assumes the liabilities of the acquiree will normally be the closing date,

- However, the acquirer might obtain control on a date that is either earlier or later than the closing date.

- the acquisition date precedes the closing date if a written agreement provides that the acquirer obtains control of the acquiree on a date before the closing date.

- Date on which control is acquired by the acquirer

- Is the agreement subject to substantive precondition, the acquisition date will be the date the last of those precondition is satisfied.

- Date when acquirer commences direction of operation and financial policies.

- Date when majority of board members are appointed.

- Date from which the flow of economic benefit changes.

- Date of clearance by competition authority (if any).

3.Consideration transferred:

The consideration transferred in a business combination shall be measured at acquisition date fair value, which shall be calculated as the sum of the following:

-

- acquisition date fair values of the assets transferred by the acquirer.

- the liabilities incurred by the acquirer to former owners of the acquiree.

- and the equity interests issued by the acquirer.

- Examples of potential forms of consideration include cash, other assets, a business or a subsidiary of the acquirer, contingent consideration, ordinary or preference equity instruments, options, warrants and member interests of mutual entities.

Contingent consideration to be paid by the acquirer:

Initial treatment:

Recognition – Always recognise

Measurement – Fair value at acquisition date

Classification – As Financial Instrument in most cases liability /equity as per IndAS 32

Subsequent treatment:

Equity – Not re-measured

Liability – Re-measured at fair value through P&L in accordance with IndAS 109

No adjustment made to goodwill, except in case of provisional accounting during the measurement period when :

- Additional/ new information becomes available during the measurement period on facts and circumstances that existed at the acquisition date.

- Measurement period is not to exceed one year from acquisition date.

Recognition and measurement principle:

At the acquisition date, the acquirer shall recognize, separately from goodwill:

- the identifiable assets acquired,

- the liabilities assumed; and

- any non controlling interest in the acquiree.

Measurement at the fair value at acquisition date.

4.Measurement of goodwill:

Bargain purchase:

A bargain purchase is one where the goodwill is negative.

A bargain purchase might happen, for example, in a business combination that is a forced sale in which the seller is acting under compulsion. In such cases, the acquirer should reassess whether it has correctly identified all of the assets acquired and all of the liabilities assumed. If reassessment confirms bargain purchase, any gain is recognized in equity as capital reserve on the acquisition date.