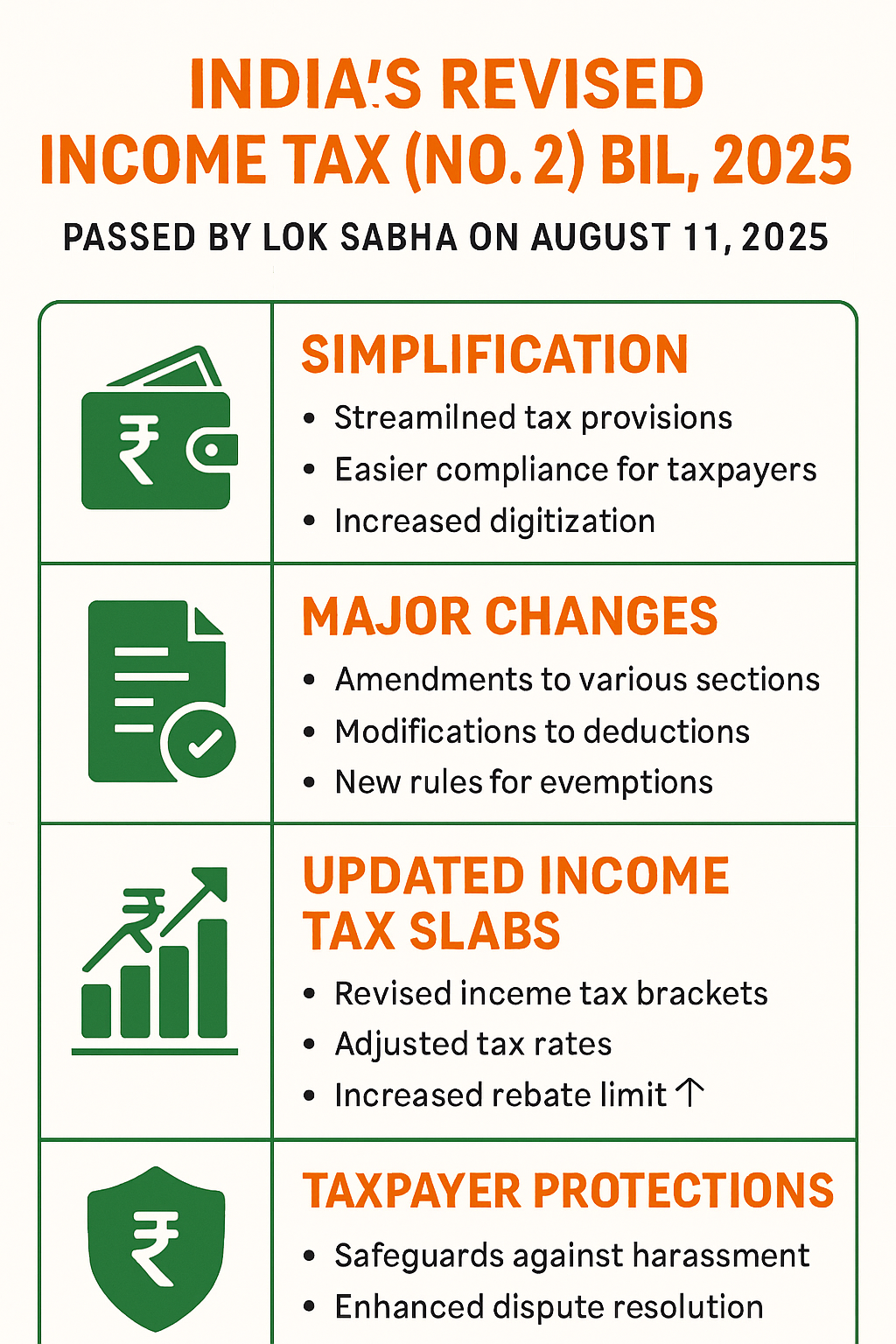

On August 11, 2025, the Lok Sabha passed the highly anticipated Revised Income Tax (No. 2) Bill, 2025, ushering in a new era of tax compliance and clarity for taxpayers in India. This landmark legislation is set to replace the antiquated Income Tax Act of 1961, simplifying six decades of tax law and aiming to make India’s tax system more transparent, modern, and friendly to both individuals and businesses.

Key Objectives and Background

- Simplification: The bill carries the government’s push to make tax laws S.I.M.P.L.E:

- Streamlined structure and language

- Integrated and concise

- Minimised litigation

- Practical and transparent

- Learn and adapt

- Efficient tax reforms

- Inclusive revision process: The government incorporated 285 recommendations (including 32 major changes) from the Parliamentary Select Committee led by BJP MP Baijayant Panda. These included stakeholder feedback and public consultation to resolve ambiguities and modernize sections of the law.

Major Changes in The Revised Bill

1. Structural Overhaul

- Number of sections reduced from over 800 to 536, comprising 23 chapters.

- The law’s wording was trimmed from 512,000 words to about 260,000, enhancing readability for the average taxpayer.

2. Unified Tax Period

- The bill merges the concepts of “previous year” and “assessment year” into a single “tax year,” making it easier to reconcile incomes and tax liabilities in one financial period.

3. Digital-First Compliance

- Assessment and compliance procedures will be largely paperless, faceless, and digital to minimize human interface, boost transparency, and curb corruption.

Updated Income Tax Slabs (Clause 202(1))

| Income Range (₹) | Tax Rate |

|---|---|

| Up to 4,00,000 | Nil |

| 4,00,001 – 8,00,000 | 5% |

| 8,00,001 – 12,00,000 | 10% |

| 12,00,001 – 16,00,000 | 15% |

| 16,00,001 – 20,00,000 | 20% |

| 20,00,001 – 24,00,000 | 25% |

| Above 24,00,000 | 30% |

Taxpayer Protections and Clarifications

- Prior notice to taxpayers before any tax action, with the right to respond.

- Refunds on TDS: Allows TDS refunds even after ITR deadlines, with provisions for advance NIL-TDS certificates for those not liable.

- Home Loan Benefits: 30% standard deduction now clearly applies after subtracting municipal taxes; pre-construction interest on home loans deductible over five years for let-out properties.

- Pension Benefits: Commuted pension (lump sum payouts from pension schemes like LIC or NPS) now fully tax-deductible.

- Gifts and Relatives: The definition of ‘relative’ clarified to include both maternal and paternal ascendants/descendants, removing ambiguities on taxation of gifts from relatives.

Impact: What Does This Mean for Taxpayers?

- Individuals and MSMEs will find tax compliance easier, with fewer sections and more transparent rules.

- The move towards digital, faceless tax filings makes the process quicker and reduces corruption.

- Clearer rules on deductions, home loan interest, and pensions help optimize tax planning and reduce disputes.

- No major change in tax rates, but greater clarity and accessibility in the structure.

India’s Revised Income Tax (No. 2) Bill, 2025 marks a bold step forward in tax reform—making compliance easier and more transparent, promoting fairness, and adapting to the digital economy. Taxpayers and professionals may look forward to smoother assessment and more straightforward law, effective from April 1, 2026, once it passes through the Rajya Sabha and receives presidential assent.

New Income-Tax (No.2) Bill 2025

[As Introduced in Lok Sabha on August 11, 2025] is attached herewith for your reference.