What is Form 26AS:

The Ultimate Guide to India’s Tax Credit Statement

Form 26AS represents one of India’s most important tax documents, serving as a comprehensive tax credit statement that consolidates all tax-related information associated with a taxpayer’s Permanent Account Number (PAN). This digital tax passbook has evolved significantly since its introduction, becoming an indispensable tool for accurate tax compliance and filing. With the Income Tax Department’s continued digitization efforts, Form 26AS now encompasses a broader range of financial transactions, making it crucial for taxpayers to understand its features, benefits, limitations, and available alternatives.

IMPORTANCE AND BENEFIT OF FORM 26AS

- Accurate Filing of Income Tax Returns : By using the detailed information in Form 26AS ,

taxpayers can file their income tax returns accurately, avoiding any errors or omissions related to tax credit and deduction .

- To check the taxes deducted or collected ,individual can use Form 26AS to confirm TDS(tax Deducted at Source) and TCS ( Tax Collected at Source) detail form their earnings.

- Claiming Tax Credits and Refunds : If a taxpayer has paid excess TDS or TCS compared to their actual tax liability, they can claim a refund from the Income Tax Department. Form 26AS serves as proof to back such refund claims .It also helps verify the status of any refund credited during the applicable financial or assessment year.

- Traking Tax Status : Taxpayers can regularly monitor therir tax payments and deduction through Form 26AS to ensure all due taxes have been paid and accounted for .

- Identifying Discrepancies :If any discrepancies or mismatches are found in Form 26AS compared to the taxpayer’s own records , corrective action can be taken promptly to avoid any trouble in the future.

- Traditional TDS Certificates

- Form 16 remains a crucial document for salaried individuals, providing detailed salary breakdowns and TDS information directly from employers. While Form 26AS contains the same TDS information, Form 16 offers additional details about salary components, exemptions, and deductions that may not be available in Form 26AS. However, Form 16 is limited to salary income from a single employer, making Form 26AS necessary for individuals with multiple income.

- Form 16A certificates are issued for non-salary income sources such as interest, rent, and professional fees. These certificates provide transaction-specific details but require manual collection from multiple sources, making them less convenient than the consolidated Form 26AS approach.

- Modern Digital Alternatives

- The Annual Information Statement (AIS) represents a more comprehensive alternative to Form 26AS, launched by the Income Tax Department in November 2021. AIS includes not only tax credit information but also detailed income data from various sources, providing a more complete picture of a taxpayer’s financial activities. However, AIS has experienced frequent data accuracy issues and mismatches, leading to taxpayer confusion.

- The Tax Information Summary (TIS) serves as a processed version of AIS, incorporating taxpayer feedback to improve data accuracy. While potentially more accurate than AIS, TIS availability and functionality remain limited compared to the established Form 26AS system.

- Manual Tracking Systems

- Some taxpayers opt for manual TDS tracking systems, maintaining their own records of tax deductions and payments. While this approach provides complete control and immediate updates, it lacks official validation and is prone to errors and omissions. Manual systems also cannot provide the comprehensive cross-verification capabilities offered by Form 26AS.

- Pricing and Cost Analysis

- Free Government Services

- All official government channels for accessing Form 26AS are provided free of charge. This includes access through the Income Tax e-filing portal, TRACES portal, and authori bank net banking facilities.

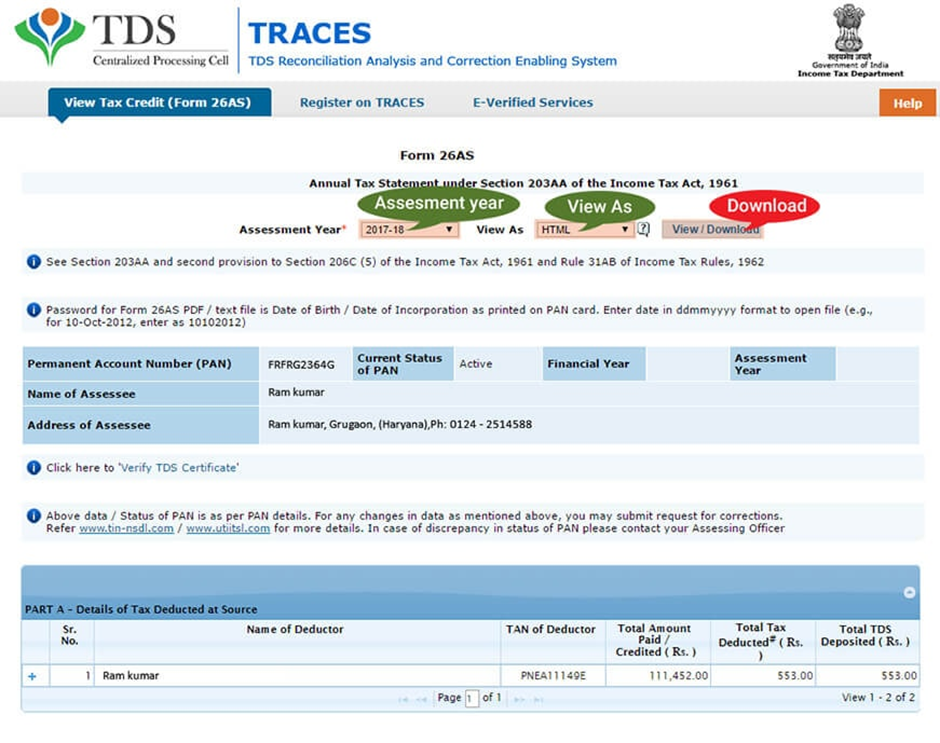

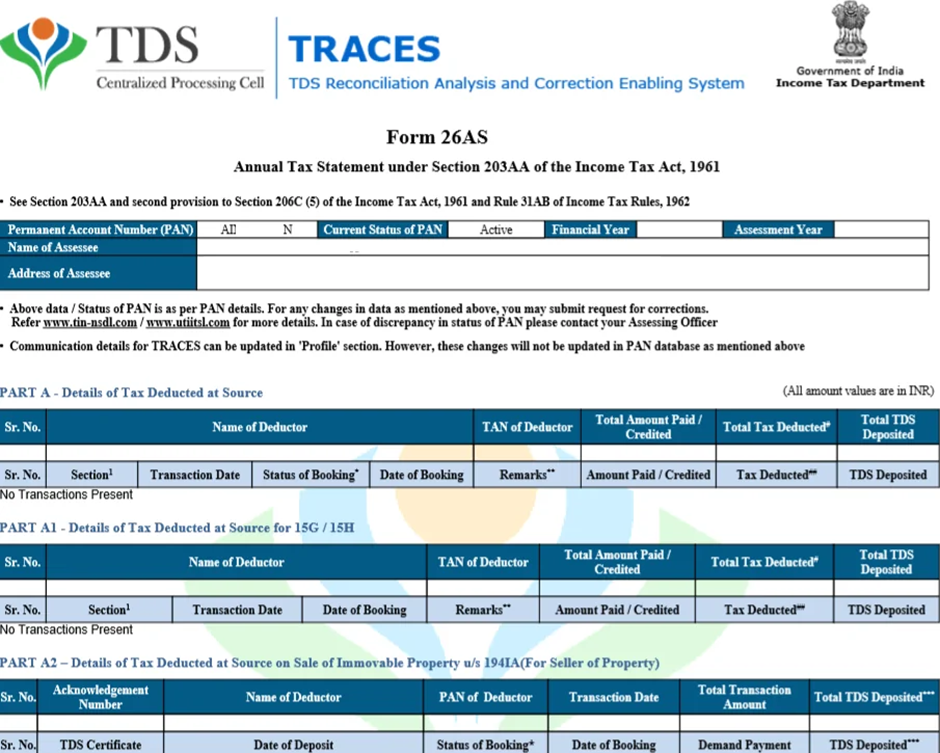

- Screenshot of Form 26AS portal showing tax credit details, assessment year selection, and TDS information for a sample PAN

- The government’s commitment to free access ensures that basic tax compliance remains accessible to all taxpayers regardless of their economic status.

- Commercial Service Pricing

- Third-party tax filing services offer various pricing models based on service complexity and taxpayer requirements.

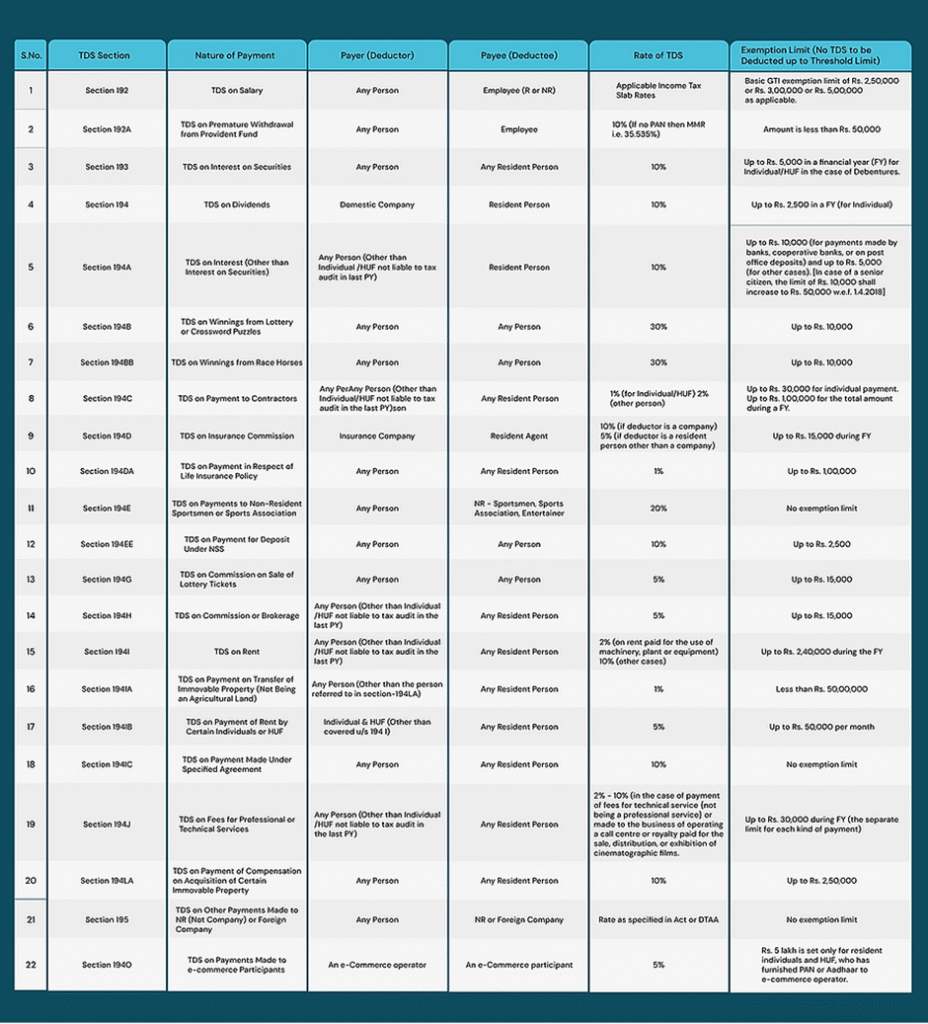

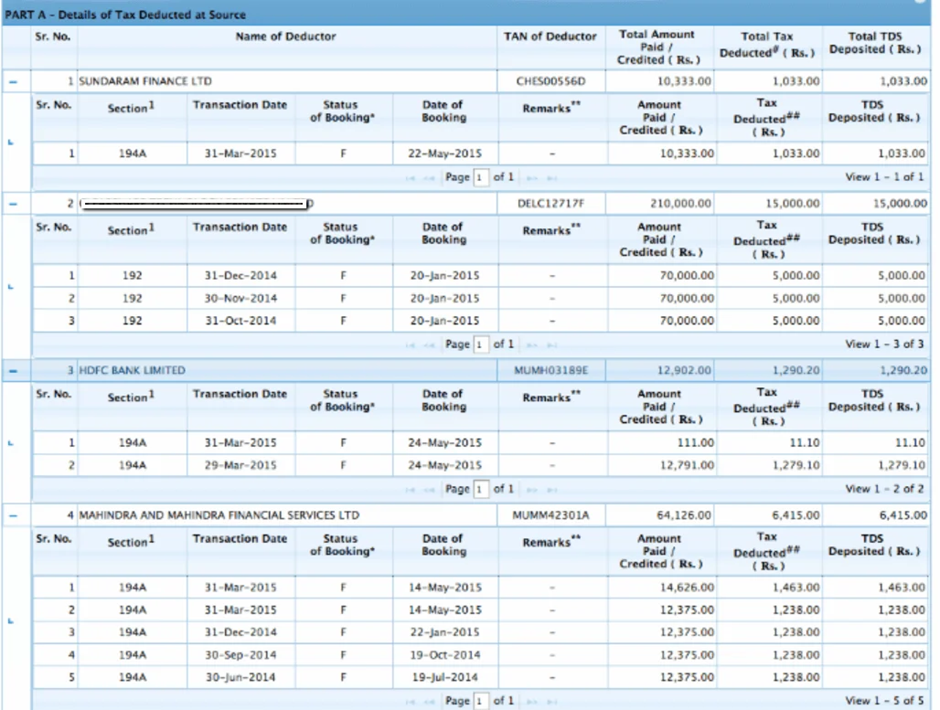

- A detailed table showing TDS sections under Indian Income Tax detailing nature of payments, deductors, deductees, TDS rates, and exemption thresholds

- Basic self-service options start from as low as Rs 49 for simple data extraction services.

- Sample Form 26AS tax credit statement showing details of tax deducted at source and deposited for various transactions by multiple deductors

- Expert-assisted services for salary income typically range from Rs 699 to Rs 2,539, while complex scenarios involving capital gains, business income, or NRI taxation can cost between Rs 2,999 to Rs 10,624.

🔍 Why is Form 26AS Important?

- ✔️ Accurate ITR Filing: It ensures you correctly report income and claim tax credits.

- ✔️ Proof of Tax Payment: Acts as evidence that tax deducted by employers or payers has been deposited with the government.

- ✔️ Identify Discrepancies: Helps you spot errors or missed entries before filing your ITR.

- ✔️ Check Refund Status: Allows you to verify the refund credited by the tax department.

- ✔️ Support for Loans & Visa: Many banks and embassies ask for tax records like Form 26AS to assess financial health.

📥 How to Download Form 26AS?

steps:

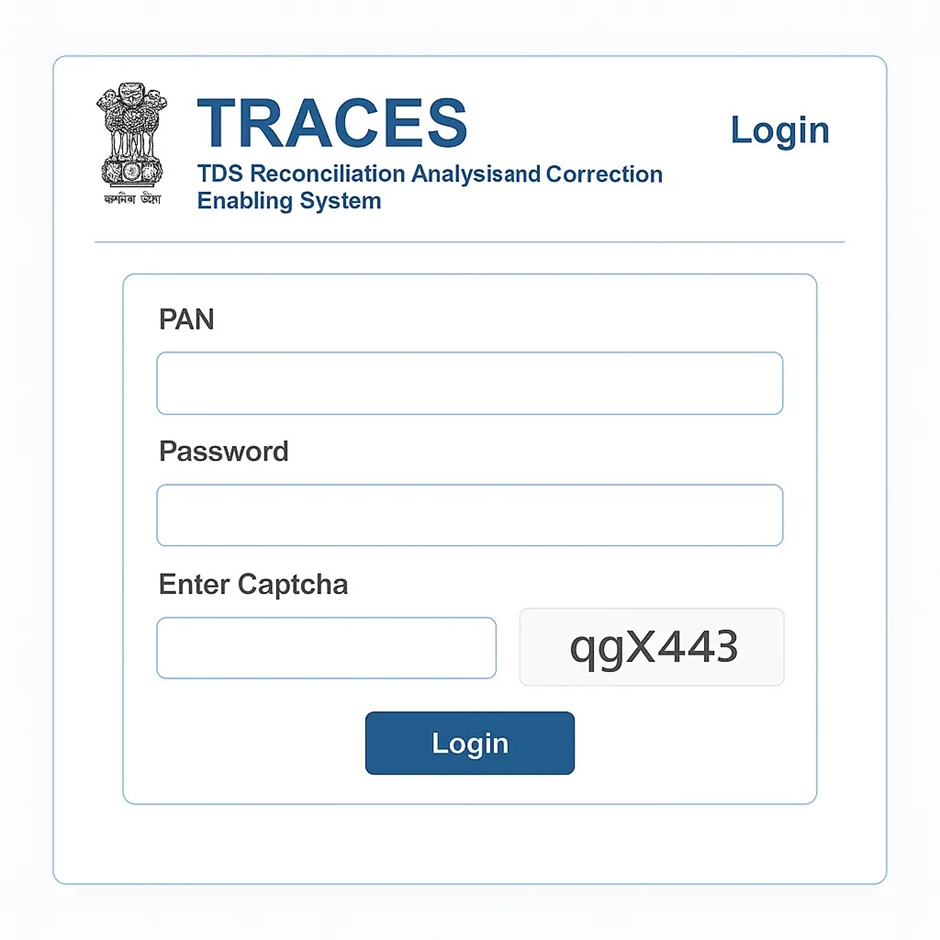

Method 1: Through the Income Tax e-Filing Portal

- website : https://www.incometax.gov.in go to on this website

- using your PAN number for login or adhaar number then enter, password, and captcha code.

- click on ‘e-File’–‘Income Tax Returns’ –‘View Form 26AS’.

- After another website TRACES portal

- Accept the terms and click ‘Proceed’.

- Choose the Assessment Year.

- Please choose a format to view the form: HTML, PDF, or Text.

- Now Click ‘View/Download’ and your Form is ready.

📌 Things to Keep in Mind While Using Form 26AS

- Ensure that the PAN mentioned in all your documents matches the one in Form 26AS.

- Compare Form 26AS with Form 16 – used for salaried income.

- Compare Form 26AS with Form 16A – used for non-salaried income.

- Check the TDS details mentioned in all the forms.

- Ensure there is no mismatch between the TDS amounts and other tax information.

- If any TDS is missing, contact the deductor (employer, bank, etc.).

- For any discrepancies, raise a correction request through the TRACES portal or via the deductor.

📝 Key Takeaways

- before filing your ITR. must-check Form 26AS

- It helps you avoid double taxation, missed tax credits, and possible notices from the IT Department.

- If the details in your ITR don’t match with Form 26AS,

- It may lead to delays in processing your Income Tax Return.

- It may even result in the rejection of your return.

- Checking and Downloading it is free, and accessible 24/7 online.

- Tax deduction at source concept depicted with financial documents and calculator deskera

- Professional software licensing for chartered accountants and tax consultants varies significantly based on features and client capacity.

- Sample Form 26AS tax credit statement showing details of tax deducted at source and related information under the Income Tax Act, India paisabazaar

- Enterprise solutions may require annual licensing fees ranging from Rs 5,000 to Rs 15,000 or more, depending on the scope of functionality required.

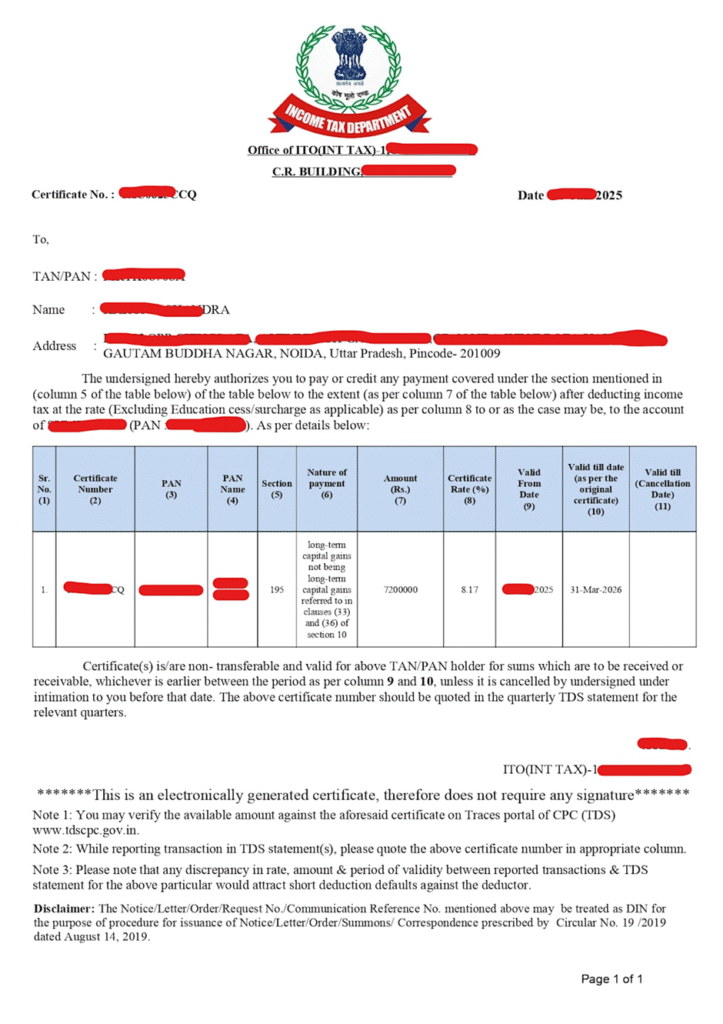

- Lower deduction certificate for TDS from the Indian Income Tax Department, showing an official authorisation for reduced tax deduction for an NRI taxpayer

- Best Practices and Recommendations

- Optimal Usage Strategies

- To maximize the benefits of Form 26AS, taxpayers should regularly review their statements throughout the financial year rather than waiting until ITR filing time.

- TRACES portal login page to access TDS and Form 26AS related information for taxpayers in India.

- This proactive approach allows for early identification and resolution of discrepancies, preventing last-minute complications during tax filing.

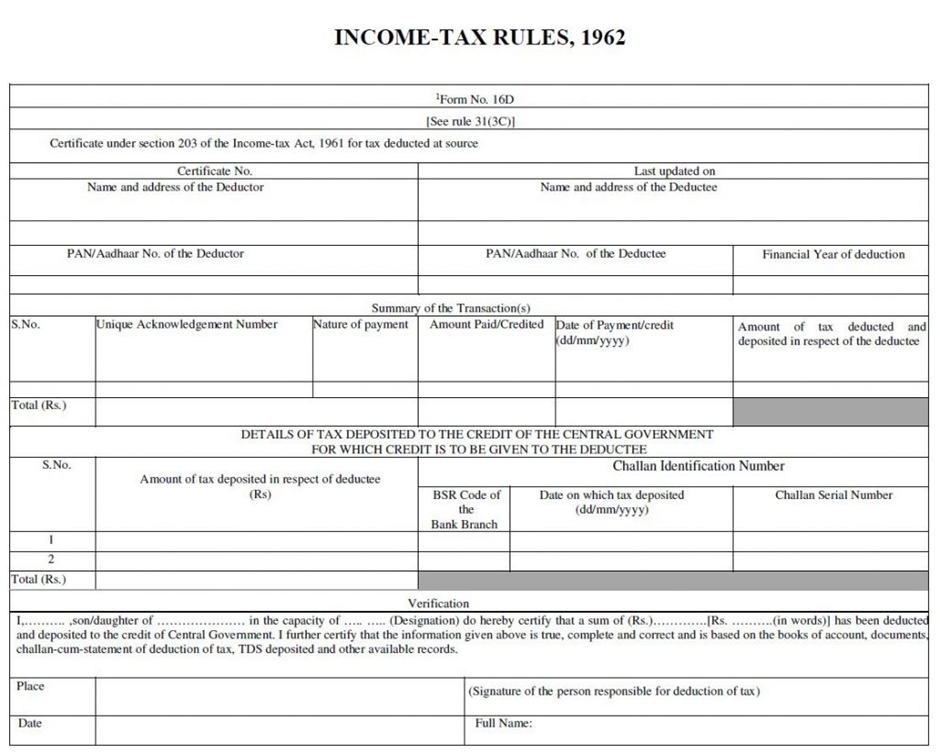

- Form 16D certificate under Income-tax Rules, 1962 showing details of TDS deducted and deposited as per section 203 of the Income-tax Act.

- Regular monitoring also helps ensure that all tax payments are properly credited and reflected in government records.

- form_26as_comprehensive_data.json

- Generated File

- Error Prevention and Resolution

- Taxpayers should maintain detailed records of all TDS certificates and payment receipts to facilitate cross-verification with Form 26AS. When discrepancies are identified, prompt communication with relevant deductors is essential for timely resolution. Maintaining documentation of correction requests and follow-up communications can be valuable if disputes arise.

- Integration with Professional Services

- For complex tax situations, integrating Form 26AS with professional tax advisory services can provide significant value. Professional services can help identify optimization opportunities, ensure compliance with changing regulations, and handle complex reconciliation issues. The cost of professional services should be weighed against the potential benefits of accurate tax compliance and optimization.

- Future Developments and Considerations

- The Form 26AS system continues to evolve with advancing technology and changing regulatory requirements. The Income Tax Department’s focus on digital transformation suggests that Form 26AS will likely incorporate additional data sources and enhanced functionality in the future. Taxpayers should stay informed about system updates and new features to maximize the benefits of this important tax compliance tool.

- Integration with other government systems, including GST networks and banking platforms, may provide even more comprehensive financial tracking capabilities. However, these developments also raise considerations about data privacy and the need for robust cybersecurity measures to protect sensitive taxpayer information.

Conclusion

Form 26AS has established itself as an indispensable component of India’s tax compliance framework, offering taxpayers a consolidated and reliable source of tax credit information. While the system has limitations and challenges, its benefits far outweigh the drawbacks when used effectively. The availability of both free government channels and enhanced commercial services ensures that taxpayers can choose the level of service that best meets their needs and complexity requirements.

Understanding Form 26AS, its alternatives, and associated tools empowers taxpayers to make informed decisions about their tax compliance strategies. As the system continues to evolve, staying informed about new features and best practices will remain crucial for optimal tax management. Whether accessing Form 26AS through free government portals or utilizing commercial services for enhanced functionality, this comprehensive tax credit statement remains fundamental to accurate and efficient tax compliance in India.